Tds Virals : U.S. sportswear giant Nike Inc. (NKE) on Tuesday released its first quarter (Q1) results, surprising Wall Street. The company posted better-than-expected revenue and profit. However, the management’s tone for the upcoming months was less optimistic. Nike warned that the upcoming holiday season may remain sluggish and that new U.S. tariffs could impose an additional burden of over $1.5 billion.

Unexpected Growth in Sales – Nike’s total revenue for the quarter came in at $11.72 billion, up about 1% year-over-year. Analysts had expected sales to remain flat or even decline slightly, but the company delivered an unexpected positive growth. This provided some relief to investors, especially at a time when global economic slowdown, weak demand in China, and rising competition have been major challenges for Nike.

Profit Beats Estimates Nike’s earnings per share (EPS) stood at 49 cents, while Wall Street’s estimate was just 27 cents. This indicates the company outperformed expectations through cost control and improved operational efficiency.

Margin Decline a Concern – Despite strong results, Nike’s gross margin fell to 42.2%. The decline was largely due to higher production costs, logistics expenses, and the impact of new U.S. tariffs. In addition, discounts and promotional activity to attract consumers also weighed on margins.

One of Nike’s biggest challenges remains its performance in China. Sales in the Greater China region declined during the quarter. Post-pandemic, Chinese consumer spending has been weaker, and local brands such as Li-Ning and Anta have taken away market share. Nike’s management admitted that Greater China continues to be a weak spot in its recovery story.

Wholesale Business Showing Promise – The company noted that its wholesale business is showing signs of recovery. After several years of focusing heavily on direct-to-consumer (DTC) sales, Nike is now seeing renewed momentum through wholesale channels. Inventory levels are being reduced, which could help bring better balance in the months ahead.

Holiday Season Remains a Challenge – Nike warned investors that the upcoming holiday season may not be as strong as in previous years. Consumer spending in the U.S. and Europe remains under pressure due to inflation and higher interest rates. Demand for sports shoes and athletic gear is steady, but lacks the earlier momentum.

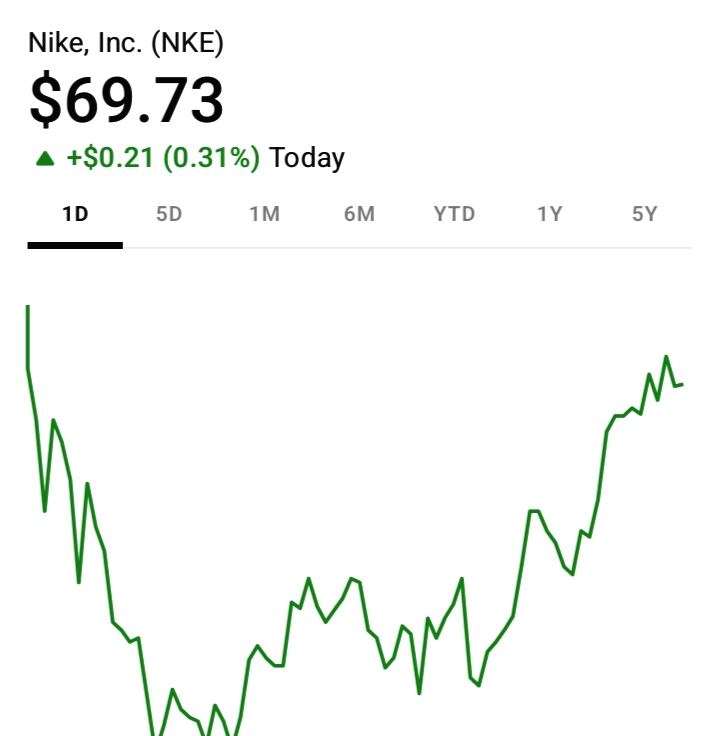

Stock Market Reaction-nike Following the earnings release, Nike’s stock (NKE) traded at $69.73 on Tuesday. During intraday trading, the stock touched a high of $73.81 and a low of $68.83. The volatility reflects that while investors welcomed the earnings beat, they remain cautious about the forward guidance.

Nike stated it will continue to strengthen its supply chain, focus on product innovation, and invest in digital platforms. However, management also acknowledged that “the recovery will not be linear.” This means performance in upcoming quarters could remain uneven.

What Does This Mean for Investors?

- Positives: Both revenue and profit exceeded expectations; EPS came in more than double estimates.

- Negatives: Margins are shrinking, China sales remain weak, and tariff costs are rising.

- Investor Sentiment: The stock could remain volatile in the short term, but Nike’s strong brand value and global reach continue to provide a solid long-term foundation.

Conclusion – nike

Nike has once again proven its ability to perform under tough circumstances. The first quarter results were strong, but management’s warnings make it clear that the road ahead won’t be easy. Sluggish demand in China, rising tariffs, and a potentially weak holiday season could weigh on the company’s performance. For now, Nike stock presents a “mixed picture” for investors — impressive earnings on one hand, and significant challenges on the other.